"it is necessary for any bank that wants to be competitive in the future to make sure that it has the ability to interact and interoperate with DeFi systems as they emerge. This will indeed happen, but the question on everyone's mind is how and in what order. We don't know the answer to those questions."

While such a statement demonstrates the traditional banking industry’s interest in decentralized finance (DeFi), it also perfectly illustrates the potential for innovation that this ecosystem represents.

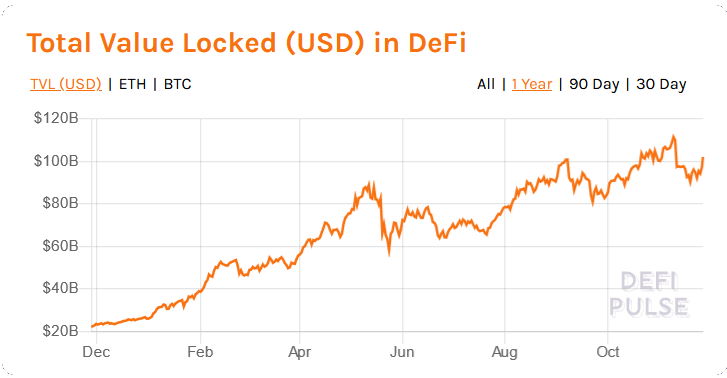

DeFi or open finance is likened to an alternative to the traditional banking and financial system developed on open and decentralized blockchain networks (such as Ethereum, Binance Smart Chain, Terra, Solana, Avalanche, etc.). The goal of DeFi is to enable greater access to financial services traditionally offered by banking and financial institutions without a trusted third party. The total value locked in decentralized finance (DeFi) grew with 350% over the past year. Since the emergence of DeFi, approximately $106 billion in assets have been placed in decentralized finance protocols, of which 83 billion in 2021.

Decentralized finance protocols necessarily rely on a decentralized infrastructure. Indeed, programmable blockchain networks provide a supporting role for the development of these decentralized applications (DApps). Among these, Ethereum is undoubtedly the blockchain most involved in decentralized finance.

The characteristics of DeFi

DeFi represents an ecosystem of protocols that are intended to work together. These are not always competing: in many cases, they evolve in symbiosis and reinforce each other.

DEFI use cases

What are the main use cases for DeFi ?

DEFI Use case 1. Tokenization

Stable tokens (stablecoin)

A stablecoin is a type of crypto-asset designed to hold a stable value in the crypto-asset and DeFi markets. While the mechanisms vary for each stablecoin, these tokens are meant to be resistant to market volatility, and thus should not experience significant price fluctuations.

There are currently three main categories of stablecoins:

- Stablecoins backed by fiat currencies (fiat collateralized): such is the case with Tether or USD Coin, which are both backed by the dollar. Euro-backed stablecoins are also beginning to develop, although the vast majority of stablecoins are dollar-backed.

These stablecoins have the particularity of having one or more crypto-assets such as ether as an underlying asset. Maker DAO’s DAI is one of the most popular crypto-collateralized stablecoins. The DAI works through the CDP “Collateralized Debt Position” smart contract which allows the collateral to be locked into the contract in ether. The value of the DAI tracks the value of the dollar.

Non-collateralized stablecoin: governed by an algorithm that prompts market participants to buy or sell in order to keep the price of the asset stable. One of the best known algorithmic stablecoins is Anchor, issued by Terraform Labs

Wrapped coins

Wrapped tokens allow crypto-assets such as Bitcoin to be sent to the Ethereum network so that they can be used directly in the DeFi. Wrapped tokens allow their holders to earn interest on their Bitcoins (initially incompatible with other blockchain networks such as Ethereum) by making them available on lending platforms (as collateral or in liquidity pools) for example. In recent months, the advent of decentralized finance has led to a sharp increase in wrapped bitcoins (WBTC).

DEFI use case 2. Loan and Borrowing Services

Lending markets are one of the main use cases for decentralized finance. Decentralized lending protocols connect borrowers to lenders of crypto-assets.

One popular platform, Compound, allows users to borrow crypto-assets or deposit their own crypto-assets for other users to borrow. Depositors receive interest, paid in the same crypto-asset as the one being deposited.

Most decentralized lending protocols set their interest rates algorithmically, so if there is a higher demand to borrow a crypto asset, interest rates will be pushed higher.

DEFI Use case 3. Trading platforms DEX

At first glance, decentralized exchange platforms are similar to traditional platforms, like Coinbase, Bittrex, Kraken or Paymium for example. But while the latter are centralized, DEXs are not managed by any central entity for the most part (on the other hand, some important DEXs like Uniswap are managed by a company in parallel). These protocols allow transactions with a wide range of crypto-assets, which are mostly not listed on centralized exchange platforms.

DEXs work in particular on the liquidity made available by the users of the protocol. Indeed, to ensure transactions without a centralizing entity, the various pairs of crypto-assets are pooled in liquidity pools – fed directly by the holders of crypto-assets who wish to benefit from a fraction of the transaction fees

Derivatives

Derivatives are financial instruments whose value fluctuates based on changes in the rate or price or any other variable related to another asset called the underlying. Generally speaking, these products are used by sophisticated investors who wish to hedge against a variety of risks – currency, volatility or others.

The main categories of derivatives are:

- Futures

- Swaps

- Options

- Forwards

In recent months, the issuance of derivatives has gradually developed within blockchain technologies and the DeFi ecosystem. They generally require an oracle (i.e., a program that allows information that is not “natively” included in the smart contracts to be sent to the smart contracts) to track these variables and therefore introduce certain dependencies and centralized components.

To date, the best known projects specialized in decentralized derivatives are Synthetix, UMA and dYdX.

Aggregators

Decentralized Exchanges aggregators allow DeFi users to trade assets at a lower cost. These platforms list most of the decentralized exchange protocols in order to pool the level of liquidity as well as the conversion rates that these platforms offer and provide the best comparison for users.

To date, one of the best known DEX aggregators is Paraswap.

Insurance

To cover risks related to the operation of DeFi protocols – including risks related to hacking of the smart contract, or the risk of loss of value of a stablecoin – it is possible to subscribe to decentralized “insurance policies” on the Ethereum network. In effect, users make their crypto-assets available on a liquidity pool in exchange for interest, and in the event of the realization of the risk (which is by nature random), the people who have subscribed to the “insurance policy” are compensated from the funds placed in the liquidity pool. Several projects like Unslashed or Nexus Mutual offer this type of service on the Ethereum network.

Dispute resolution platforms

Some decentralized finance protocols use smart contracts to resolve different types of disputes: commercial, intellectual property, decentralized governance, etc. This is akin to a form of private arbitration that users of a smart contract consent to by choosing to use it.

Kleros is the most widely used decentralized justice protocol to date. Founded in 2017, the platform allows holders of the protocol’s native tokens ($PNK) to become anonymous jurors and participate in dispute resolution. Since its deployment on the Ethereum blockchain, the platform has resolved over 900 disputes.

Marketplaces

Finally, there are many fully decentralized marketplaces that allow the exchange or sale of assets on the primary and secondary market – including non-fungible tokens (NFTs) via smart contracts. Most of these marketplaces are established on the Ethereum network and even allow to issue their own NFTs. Opensea, Rarible and Super Rare are the three main decentralized NFT marketplaces deployed on Ethereum.

and a multitude of other use cases...

Finally, let’s note that there are a variety of other use cases in the DeFi sector such as prediction platforms (with Augur), lossless lotteries (with PoolTogether), real estate investment platforms (with RealT), stabilization of expected future returns from a DeFi protocol (with APWine), projects related to governance of DeFi protocols (with Paladin), etc.

Conclusion about DEFI

Decentralized finance tends to reshuffle the deck of the current financial system in many ways. Thanks to its inclusiveness, accessibility and decentralization, its still developing applications provide an interesting alternative to the financial services offered by traditional financial institutions. To date, more than 240 billion assets are under management in the various decentralized finance protocols, and this number is set to grow.

DeFi perfectly exploits the opportunities offered by blockchain networks, which ensure the traceability of past transactions (the register of transactions is public), mitigate counterparty risk (a user can only borrow if he has previously deposited collateral of a higher amount on the same protocol), and resist censorship (blockchains are based on a decentralized architecture and are accessible to anyone with an Internet connection).