Bad news: inflation may not be coming down. Worse, it is going back up. “Well”, you say, “Everyone else says it is coming down…”.

Okay, I’ll explain this train-of-thought :

The CPI YoY chart indicates inflation is going down. If you look at the data : we were at 8.20% inflation last month, and now 7.75%. That is 0.45% less inflation. Hurrah, we’re doing great !

But… that 7.75% is from this october, compared to october last year. And from september to october last year, we had a 0.83% increase in inflation. So your ‘basis of comparison’ is 0.83% higher from september 21 to october 21. So october 22 will automatically show a 0.83% improvement if prices remained the same. But CPI yoy only shows 0,45% improvement.

| 2021 | 2022 | combined | |

| sep | 5,39 | 8,2 | 13,59 |

| oct | 6,22 (+0,83) | 7,75 (-0,45) | 13,97 (+0,38) |

Thus, if you take 2020 as ‘zero/baseline’, and add the yoy per month inflation, where it seems inflation came down in october 2022 by 0.45%, the comined inflation compared to 2020, is actually going up 0.38%.

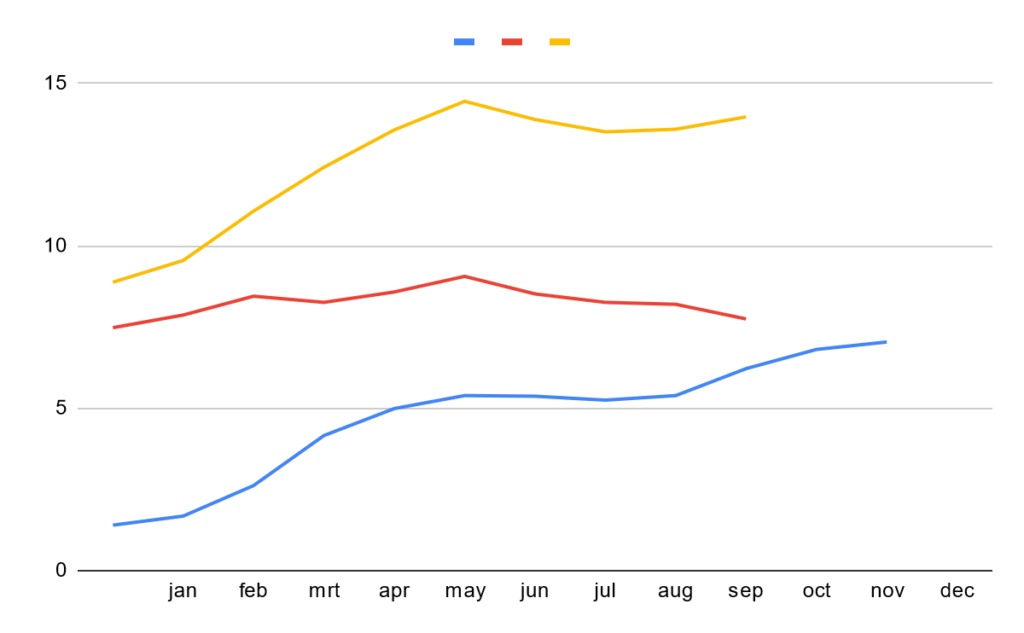

This is the US CPI yoy per month :

You can take 2020 as baseline, “zero”. There was a slight inflation throughout the year, but it is mostly around 1%, 2%. That means you can use the year as a baseline. You can add 2021 and 2022, month to month. January plus january, february plus february, and so on. And then you get the combined cumulative inflation since 2020.

| 2021 | 2022 | combined | |

| jan | 1,4 | 7,48 | 8,88 |

| feb | 1,68 | 7,87 | 9,55 |

| mrt | 2,62 | 8,45 | 11,07 |

| apr | 4,16 | 8,26 | 12,42 |

| may | 4,99 | 8,58 | 13,57 |

| jun | 5,39 | 9,06 | 14,45 |

| jul | 5,37 | 8,52 | 13,89 |

| aug | 5,25 | 8,26 | 13,51 |

| sep | 5,39 | 8,2 | 13,59 |

| oct | 6,22 | 7,75 | 13,97 |

| nov | 6,81 | ||

| dec | 7,04 |

This table shows that June was indeed the actual peak inflation. Inflation has been diminishing slightly from july up to september , but last month, october, it went back up again.

You can see it more clearly in this graph : blue is 2021, red is 2022, yellow is combined. The yellow graph is going up again, blue went up more than red went down.

So if you bought in the relief rally, well, keep an eye on the market, because the market may not do what you expect. We are not at the bottom, yet.