What is fair in accounting terms is not always fair in business terms. In my preparations to launch my own token I researched the startup market and detected a number of problems. Honesty lasts longests, and if you want to develop a token as financial instrument to finance a business venture, you willl have to offer the market a fair deal.

The problem : acquiring starting capital

The current crypto market for projects has problems aquiring starting capital.

Banks and family (traditionally the main sources of startup capital) won’t finance the rather risky crypto startups. Crypto is considered the Wild West : scams, rugpulls, corrupt team members running off with the marketing wallet. Apart from that, it is an emerging market. What is hip and cool today is obsolete and old tomorrow.

And where in the normal economy 80% of startups go belly up in three years, in crypto 80% goes belly up in three months.

All in all it is considered to risky by the conventional source of starting capital, and as Jack Dorsey said (correctly) “VC owns crypto”. VC and private investors (mostly speculants).

The competition for capital is fierce

It can be very cheap to start a token project : 25 dollars to put a copy contract online with 25 dollars for a website, 1000 dollars in the liquidity pool (which you can retrieve later on), and there you go… the 50 dollar scam market.

A more realistic minimum price is 25K with 5-10K in the liquidity pool for a basic token project.

It is basically cheap to start a token project.

There are 10 to 15 new projects on CMC every weekday, the main shopping window with 300K visitors a day, and I estimate a tenfold (100) new projects are launched across all blockchains every day. They all have to compete for starting capital. And there is a small active group of VC’s or sooner private investors (speculants mostly) that supply starting capital.

Killing yourself to live

Supply-and-demand dictates all projects have to promise the moon, and sell their tokens for nickles and dimes, 50% of the tokens for 20K for instance, and most goes into the liquidity pool.

The majority currently offer a revenu share, with 10 to 15% taxation on buys and sells (with 5-10% of buys and sells distributed as rewards to hodlers) to generate cashflow for the reward stream and marketing and development wallet.

The more attractive the projects make it to the early birds, the less attractive the token becomes to later entrants.

The projects gets an initial pump (and dump) on dex launch, and if it gains any traction they might make it to CMC listing. On CMC listing they get another pump, and might run for three days, maybe even two weeks, but as said the project is not attractive to later entrants and soon the cost of attracting new buyers (heavy shilling, youtube vids and influencer marketing) outweigh the yield and the project fails to attract new buyers and stalls.

The whales know how it works, so they take profit and dump the project, and the toen price takes a 50% loss in one or two days, and it is over. The whales go find their next willing victim, the next half promising startup, and the project just withers on a bit.

Stupid is as stupid does

Everyone dreams of becoming the new Shiba Inu or the new BabyDogeCoin or Floki, but that is 1 in 10.000 projects. And most of these big popular tokens started in the recent bull market. We are currently in a bear market (with a high fear score on the fear/greed index). So don’t think you will be the new big winner.

And even the big popular tokens have the Ponzi problem, they constantly need to attract new buyers. Shiba Inu is running out of steam, and BabyDogecoin need the Binance listing or they are gonna run out of steam as well. They need to fast develop utility and develop partnerships, NFTs’, to make the token more attractive by giving it utility.

But it remains a ratrace, because all these revenu share tokens are Ponzi’s, once they run of steam they collapse and loose 50%.

Reward wars : a new hope

I would sooner develop a different rewards distiribution method.

Under Dutch law you cannot start a business if it is already apparent it will not last. Everyone in business knows the Ponzi financing model won’t last the distance. So under Dutch law you would not even be able to incorporate your revenu share token venture like Shiba Inu or BabyDogecoin. And as I am a pro economist, I am looking for a different rewards distribution method.

Don’t get me wrong, there is basically nothing wrong with the Ponzi model to my opinion. It works great to attract starting capital. The early birds take a sizeable risk on a startup and that should have it’s rewards. The Ponzi model is excellent for the startup phase. If a sizeable part of the market adopts the Ponzi rewards model, that is because it works under these market circumstances (for the startup phase, at least). And as mister Jesus said ‘try everything, and if it works, keep it’.

But later on the Ponzi model backfires and you need a system with (more) fair rewards. To make the token more attractive to later entrants, and lower the ‘threshold/cost’ of attracting buyers to prevent the project from stalling and imploding. A more fair rewards distribution makes the token more sustainable and might also prevent the early birds from dumping the project every time a project stalls. Because if they have a profitable investment in a sustainable business, why the hell would they dump ?

Lifo/Fifo : standard accounting systems

I was thinking of a LIFO system (last in first out) but FIFO (first in first out) may be better : token batch purchases dollar value accounting.

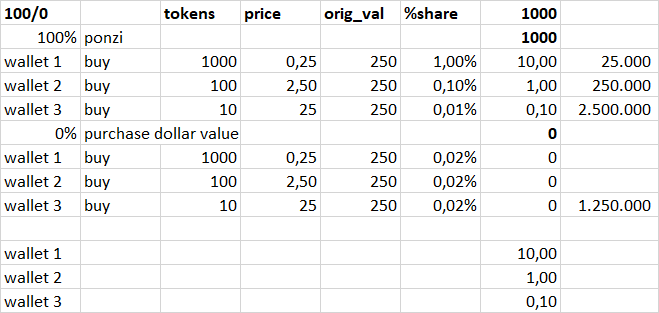

In the Ponzi model, if you pay 250 dollars for 1% tokens in the presale, you get 1% of the rewards, and if a later entrant at CMC listing buys in with 250 dollars they get 0.1% of tokens and 0.1% of rewards. That is not fair the later entrant, also because they run a higher risk in the current market of incurring a loss once the project is dumped by the early bird whales.

In a FIFO or LIFO purchases dollar value accounting method, you both bought in for 250 dollars and get the same shares in rewards.

I would prefer using a token with both methods and switch in phases.

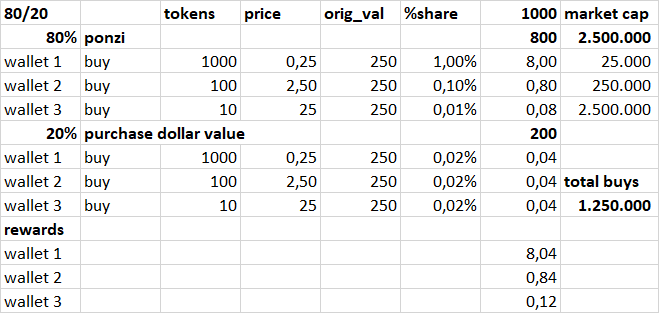

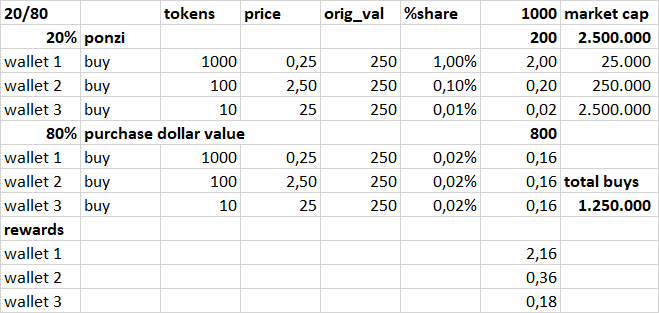

The first phase of a token should be 80/20 to attract starting capital with higher rewards for early birds :

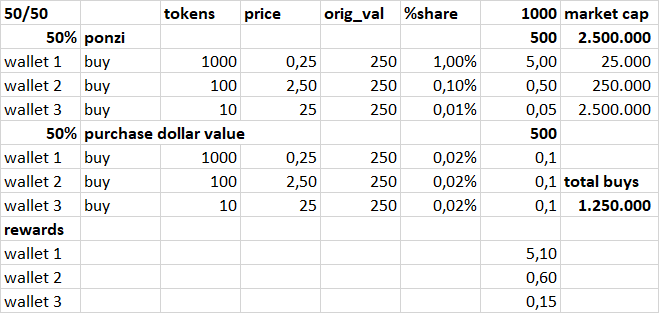

The second phase (CMC/CG listing, the first exposure to the bigger market) could be 50/50

And in the maturity phase, 20/80

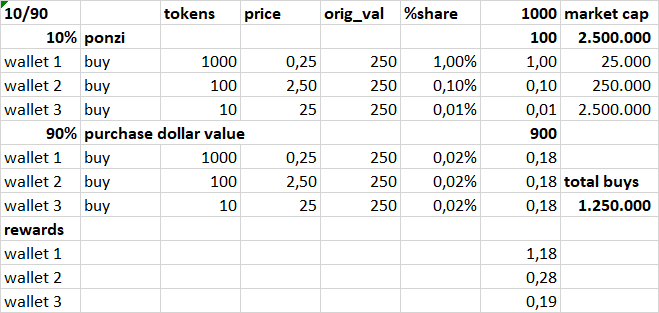

or even 10/90

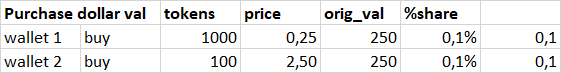

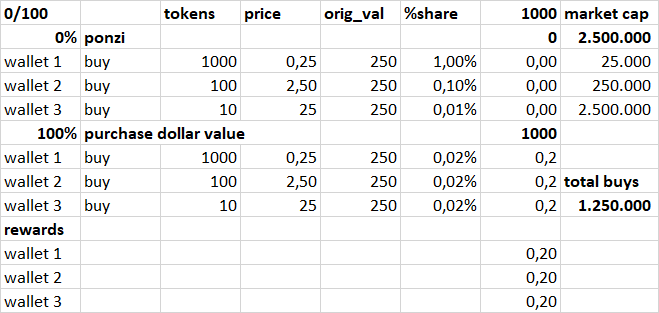

You could opt for full LIFO/FIFO :

…but then you take away an important incentive to buy as much tokens as possible.

In these examples you can almost double the rewards for late entrants over time and still give the early birds 6 times more rewards than late entrants. And it is more sustainable than the current Ponzi model.

You can offer 90% more rewards for late entrants compared to Shiba Inu.

You can make it a community call or even a DAO decision when to switch.

The cost of catching up

Another point, in a full ponzi an early bird buys 1% for 250, and the late entrant has to pay 100x more to get the same share in rewards, 25.000. In a 10/90 model the latest entrant only has to buy 62 tokens for 1550 dollars to catch up with the early bird and get the same share in rewards. A token with good utility (used as payment for NFT’s with special trading rights or access to a Yacht club for instance) becomes a lot more attractive the easier you make it to catch up with the ‘winners’. And hey, the more trade, the more rewards.

Making the token a dual reward system token increases the gaming potential of the token.

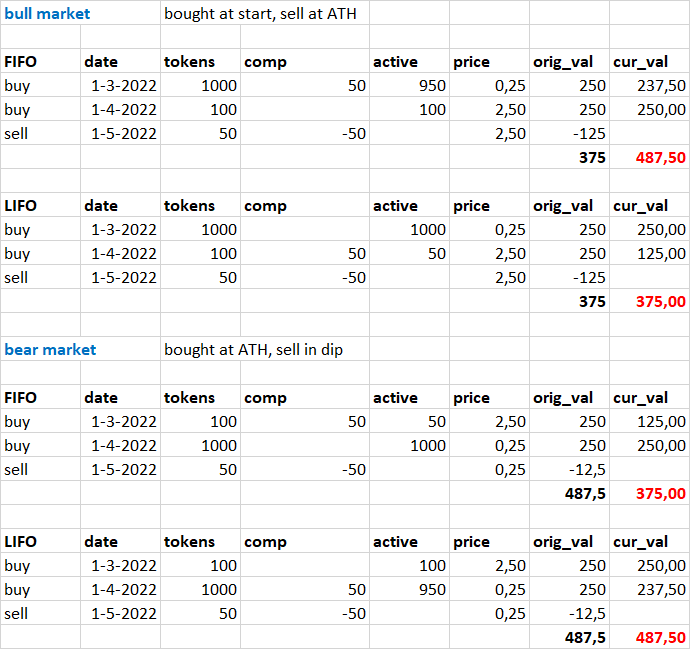

FIFO or LIFO

The above examples are extremely oversimplified just to explain the idea.

It of course works out different in reality once people start buying and selling batches.

LIFO would imply that if you buy 1% for 250 dollars (say 1000 tokens) and 0.1% (100 tokens) for 250 dollars later, you invested 500 dollars. If you later sell 50 tokens for say 500 dollars, in LIFO you would subtract the 50 tokens from the last 100 token batch and that would take away 125 dollars from your share in purchase dollar value, leaving 375 dollars.

If you use FIFO accounting, you subtract the 50 from the first 1000 token batch and substract 12,50, leaving 487,50.

And what works best for you also depends on the moment you buy and sell, if you buy at the bottom and sell at ATH or the other way around, bull or bear market.

That is quite a difference, and I don’t know which one is better. That is an endless accounting discussion, we had the same discussion in school. Some people prefer LIFO, others FIFO, beauty is in the eye of the beholder. LIFO favors the later entrants in a bear market, and discourages selling. FIFO favors the early birds in a bull market, I haven’t given it much thought yet.

I think in US taxes you are also free to choose which accounting model you use to assert your holdings value and transaction profit/loss.

Anyways, the choice between LIFO/FIFO too can be a community or DAO decision, too.

Testing it

To calculate purchase dollar value you need an oracle, I think, or you have to do it off-chain. As I am still a Solidity noob I don’t have the skills to do it on-chain yet. I am first going to build an off-chain database (I want an off chain desktop token database anyway to do simulations in Office Access and Excel, harvesting the data with PHP/mySql). I’ll be busy doing my total nerdy stuff for the next two weeks, nerd fun !

That is my idea for this week.